As of November 2024, more than 10.2 million mutual-fund investors in Indonesia held accounts through fintech-based selling agents, representing approximately 70.35% of the country’s 13.76 million mutual-fund investor base (KSEI, 2024).

For banks and fintechs, the question is no longer whether to offer digital investment services. It is how to provide those services in ways that protect brand trust and scale quickly.

Challenges of Building a Mobile Wealth Platform In-House

Developing a mobile, self-service wealth management platform internally presents several challenges that can slow adoption and increase risk:

- High Development and Maintenance Costs: Building from scratch requires extensive resources and ongoing costs for technology upgrades, security, and compliance upkeep.

- Regulatory and Compliance Complexity: Navigating wealth management regulations is demanding, requiring significant effort to implement workflows, audit trails, and reporting.

- Time to Market: Developing a competitive wealth management platform internally can take years, delaying the ability to meet growing customer expectations.

- Technological Complexity: Advanced features such as API integration, AI-powered analytics, risk management, and client self-service options are challenging to develop independently.

- Need for Scalability and Customization: Institutions require platforms that can scale efficiently and allow customization to meet evolving client demands.

These challenges make white-label, self-service engines an attractive option, enabling fast, branded mobile experiences with reduced operational risk.

That is precisely what a white-label Wealth Management System (WMS) delivers: it allows institutions to own the customer relationship and experience while avoiding the full burden of building an investment platform from scratch.

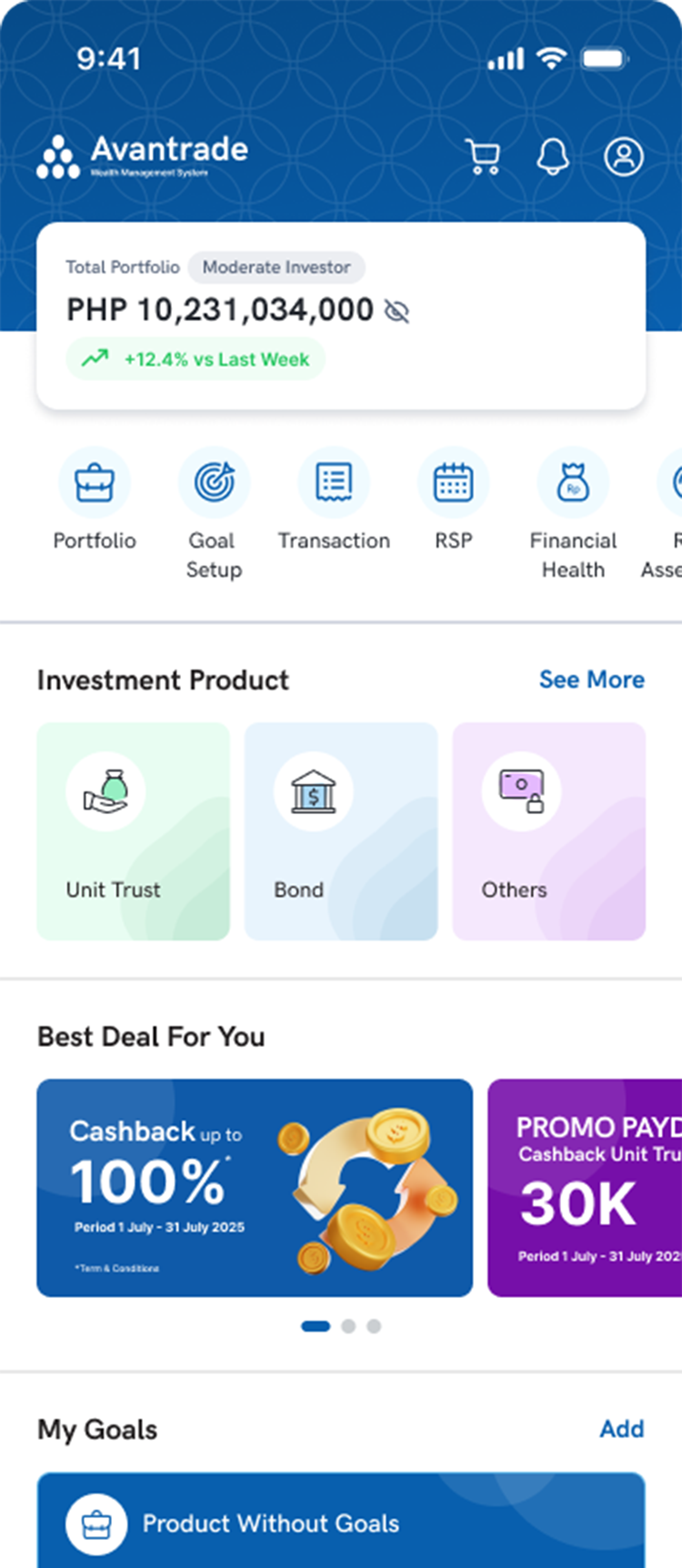

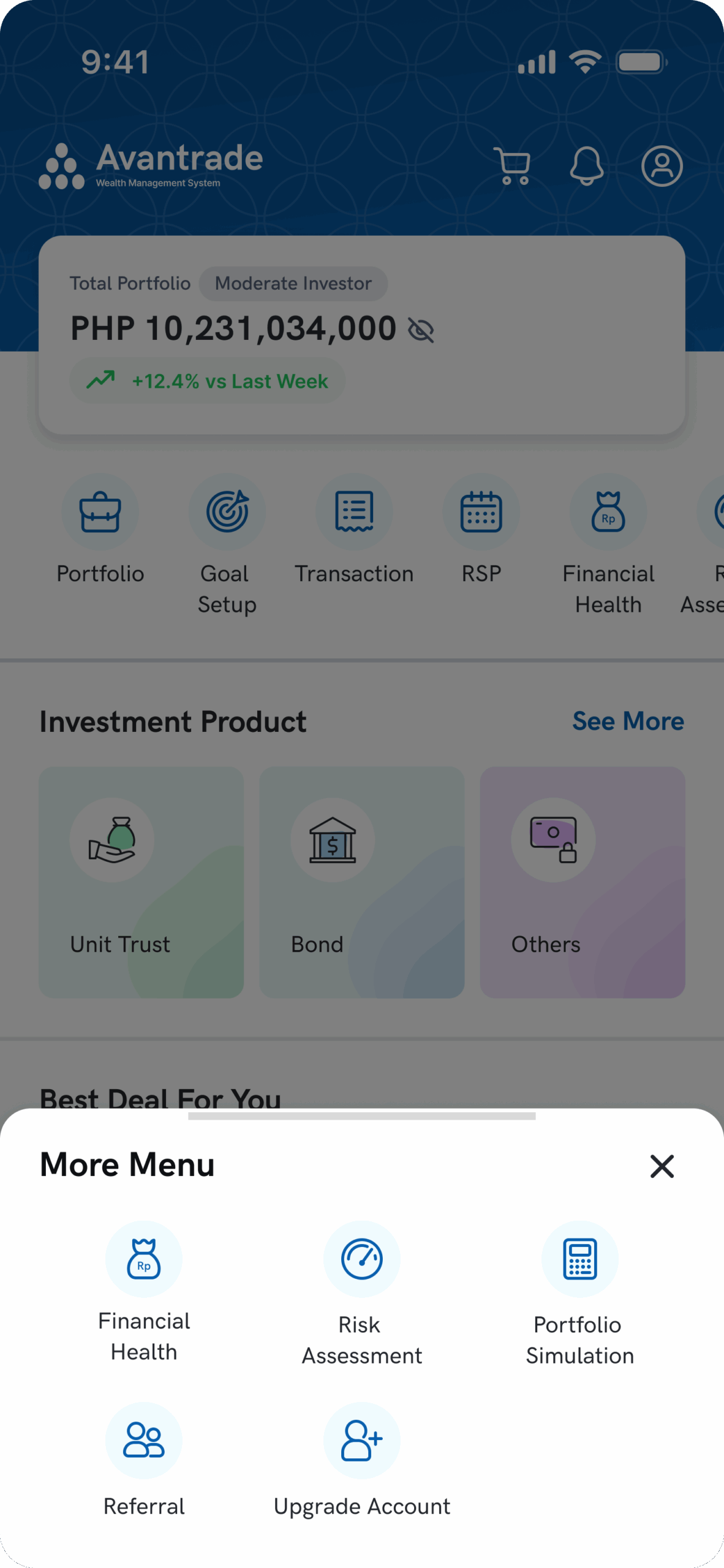

Avantrade: White-Label Wealth Management System

Built on 20+ years of trust in wealth management, Avantrade has been the trusted choice of Asia’s leading financial institutions since 2003. With more than two decades of innovation, the platform enables banks and asset managers to deliver investment experiences to their customers quickly, securely, and at scale.

Avantrade’s self-service solution is fully white-labeled, powering mobile and web channels while allowing institutions to retain complete control over the customer-facing experience. Customers can invest, grow, and manage wealth within their institution’s app, either as a standalone solution or embedded into existing mobile and internet banking platforms. The system supports iOS, Android, and web browsers for a seamless digital experience.

Avantrade’s Core Benefits for Institutions

Avantrade addresses the constraints that typically slow in-house mobile app development while delivering tangible business value:

- Faster Launch: Pre-built modules and integrations shorten development timelines from years to months.

- Brand Control: Institutions fully own the customer-facing app experience while Avantrade manages the backend.

- Regulatory Readiness: Compliance workflows, audit trails, and reporting tools are pre-configured for regulated markets.

Flexible, Pay-As-You-Grow Model: Costs scale with assets under management (AUM), avoiding heavy upfront fees and adapting to growth.

Key Self-Service Capabilities for Mobile Investors

Avantrade equips institutions with features designed to engage and retain digital-first customers:

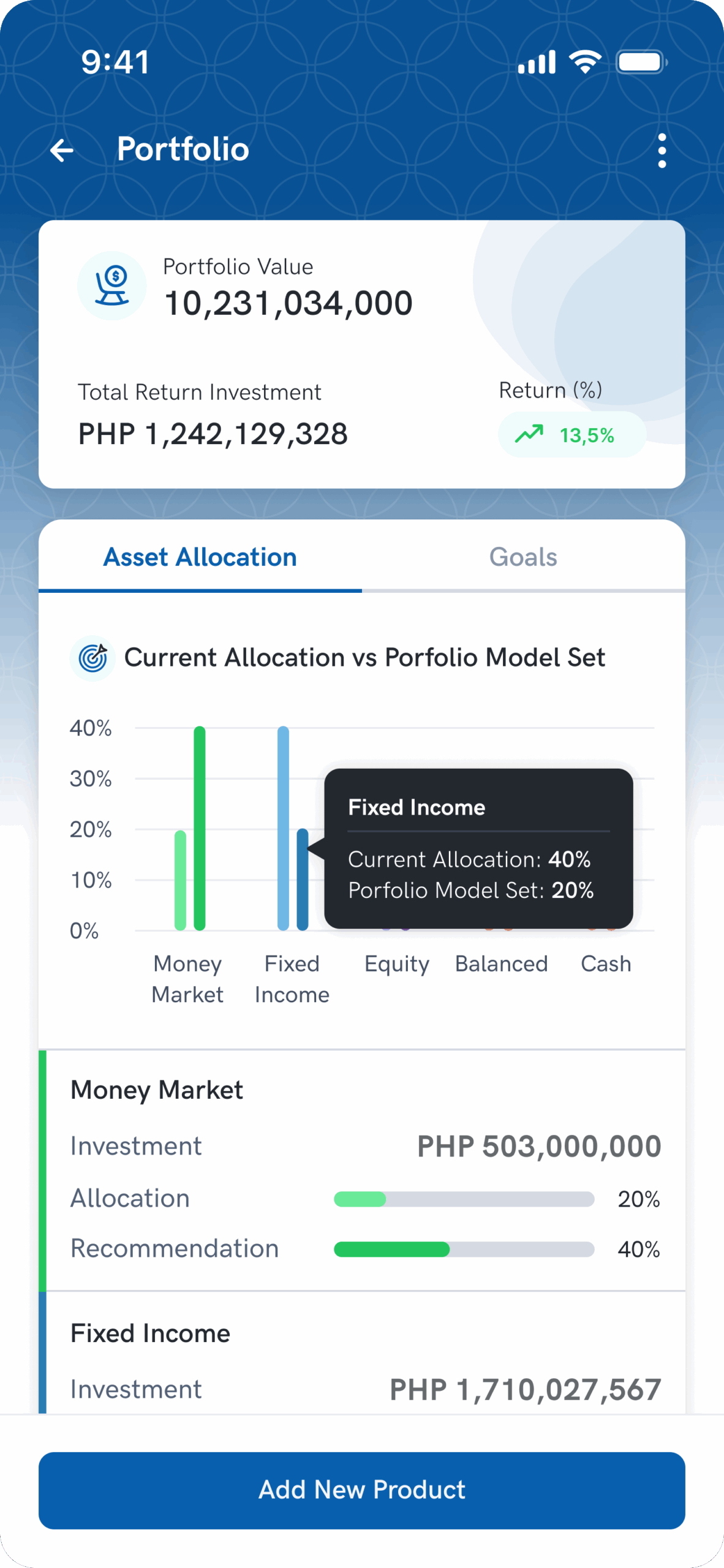

- Portfolio Overview: customers can track all investments (balances, performance, and allocation) in a single view.

- Investment Products & Recommendations: showcase mutual funds, bonds, and curated opportunities with data-driven suggestions.

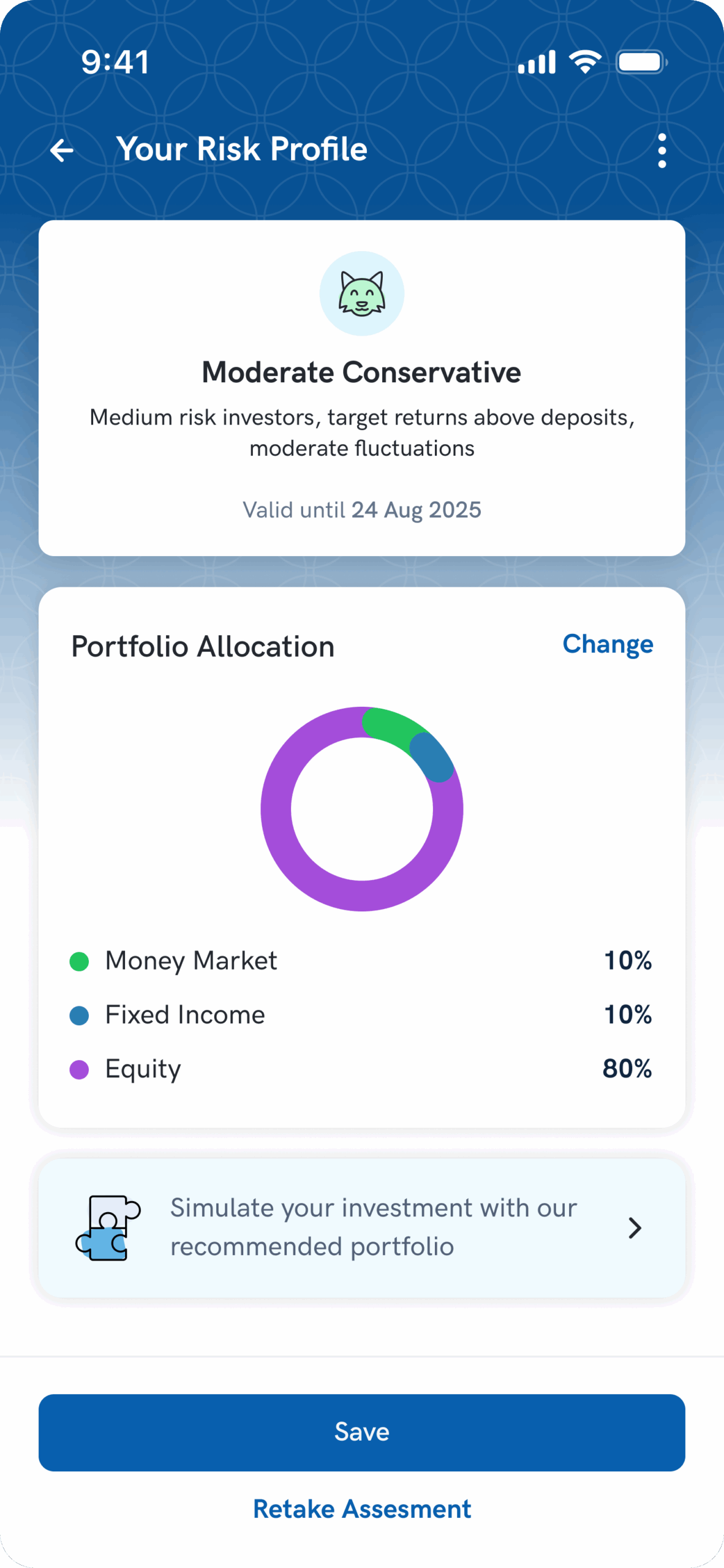

- Customer Risk Profile: help clients understand their risk appetite and align investment strategies accordingly.

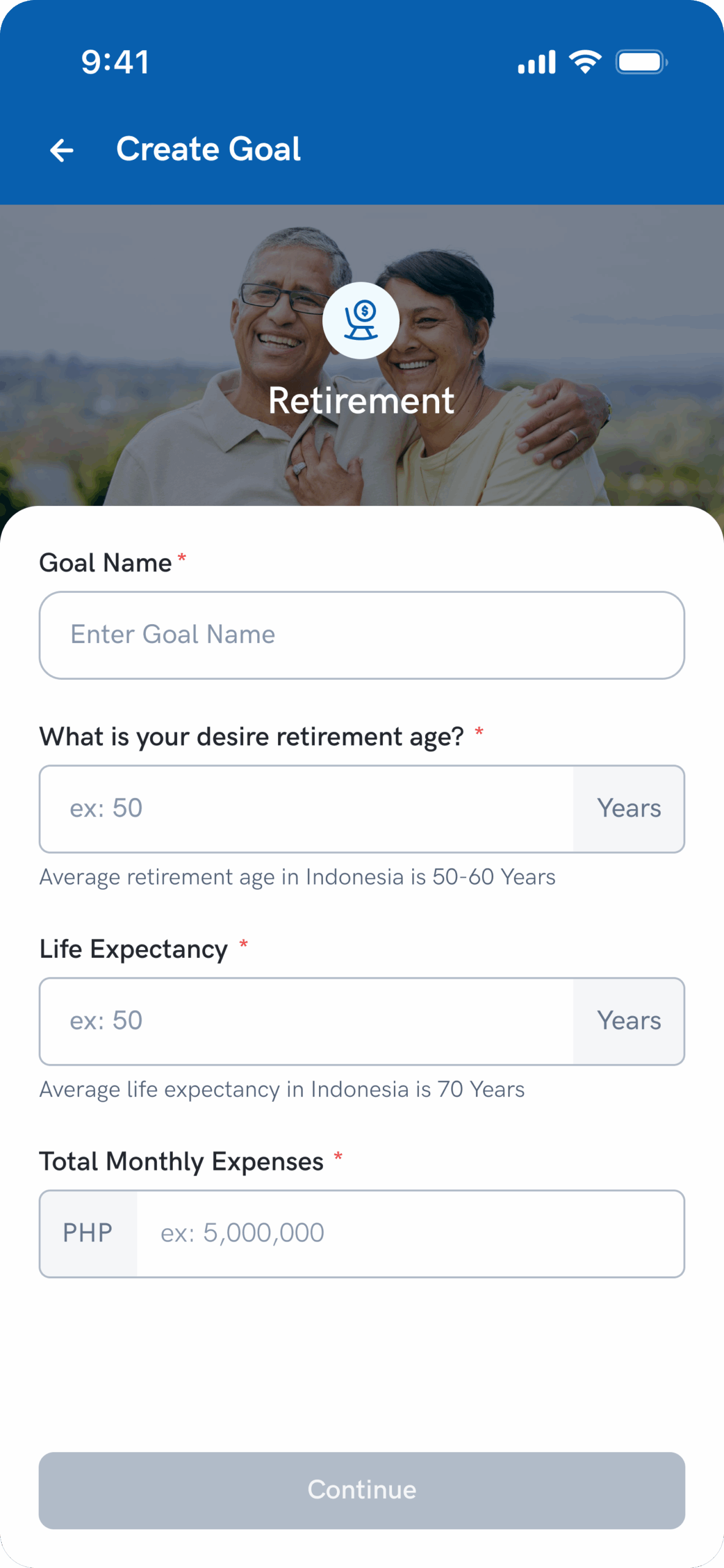

- Goal Setting & Tracking: enable customers to set financial targets, monitor progress, and receive reminders.

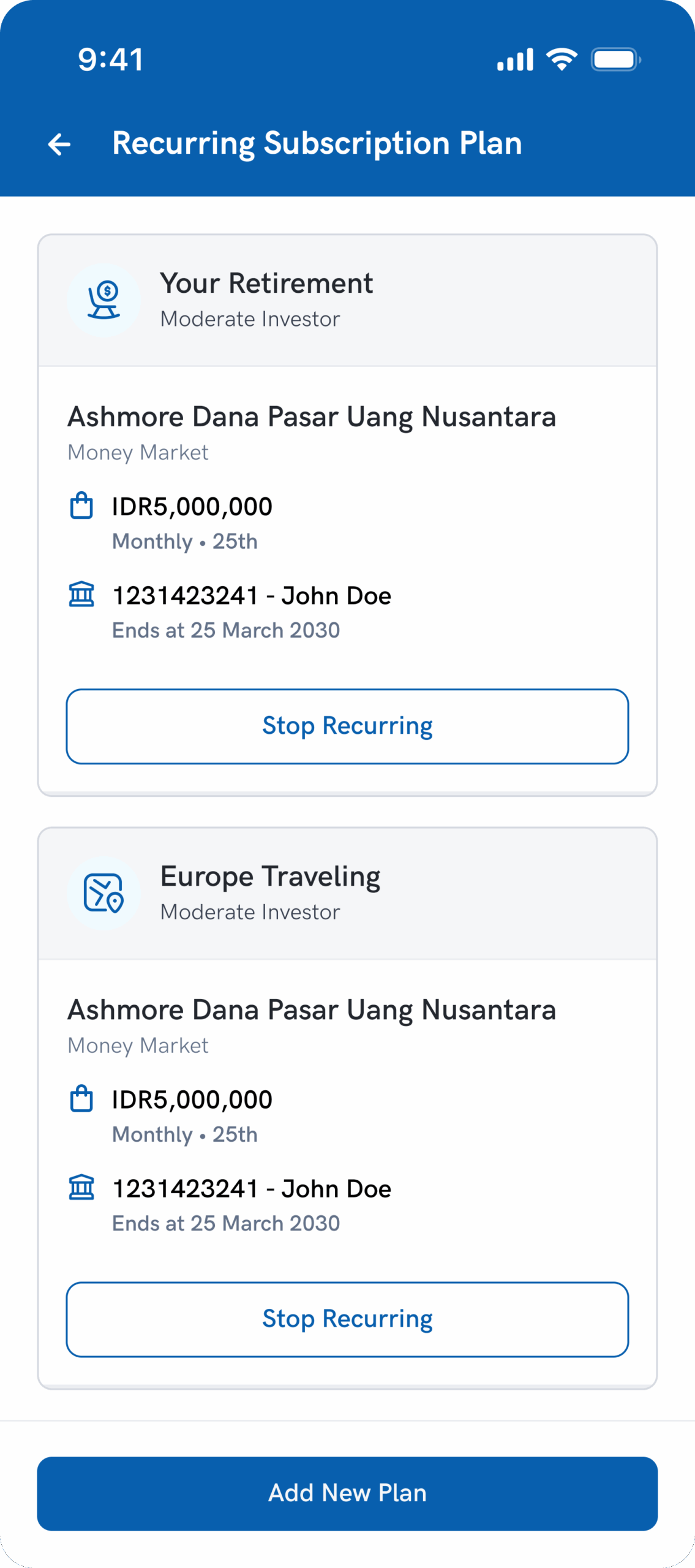

- Recurring Investment Plan: encourage disciplined investing through automated contributions.

- AI-Integrated Insights: provide AI-driven analytics to uncover patterns and guide smarter investment decisions.

- Financial Health Check: assess customers’ financial positions and identify strengths and improvement areas.

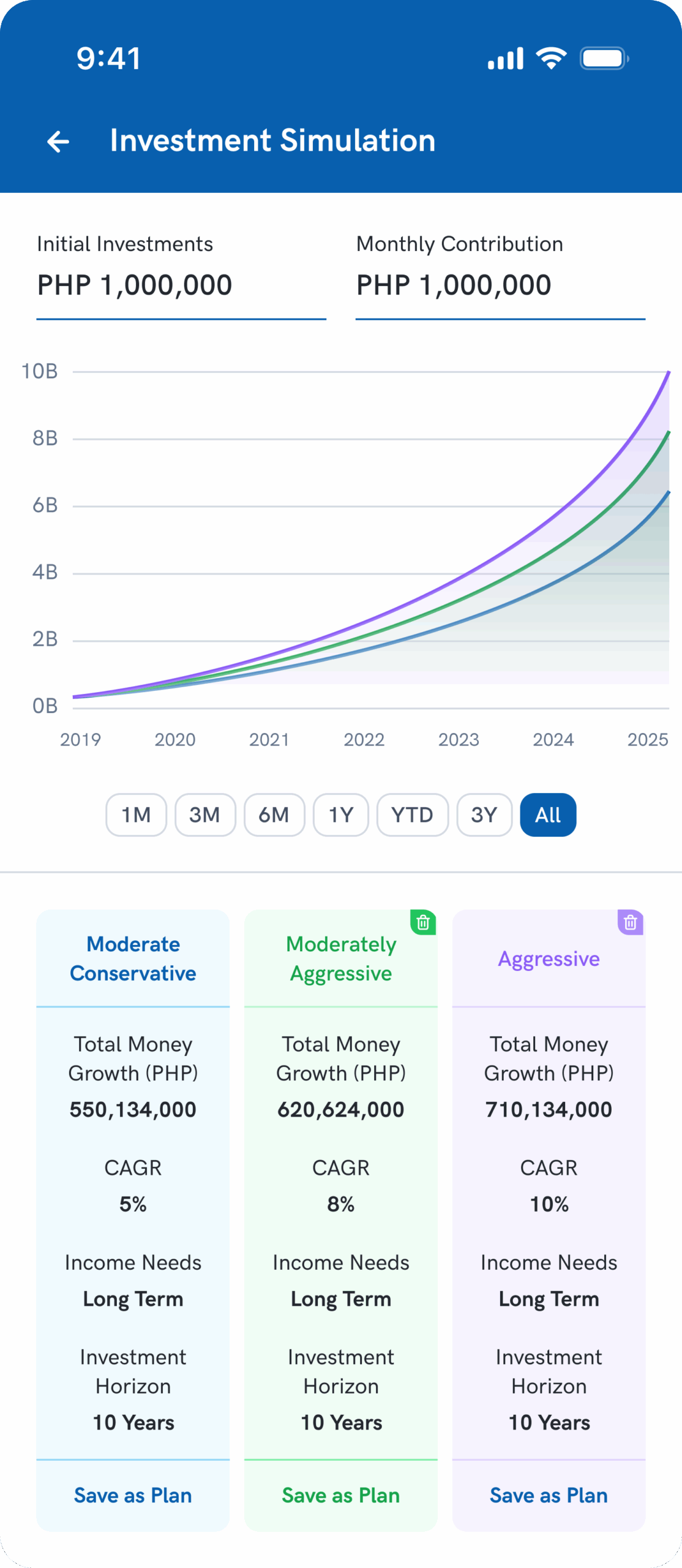

- Portfolio Simulator: allow clients to model “what-if” scenarios before making real commitments.

- News, Events & Education: provide curated articles, learning modules, and event updates to support financial literacy.

Ready to Bring Mobile Self-Service Wealth to Your Customers?

Discover how Avantrade can transform your mobile wealth offering. Contact us today to schedule a consultation and see how your institution can accelerate digital investing with confidence.

Reference:PT Kustodian Sentral Efek Indonesia. (2024, December 18). KSEI implementasikan K‑CASH, pengelolaan dana untuk transaksi reksa dana jadi lebih efisien [Press release].