Digital transactions keep gaining traction across industries, and customers now expect simple and convenient ways to pay. Many businesses are starting to explore their own branded payment solutions because they want to bring these experiences closer to their ecosystem.

A white-label e-money platform makes this possible without the long development effort or the operational burden of doing everything internally.

Why Businesses Are Turning to Branded E-Money

Customers want payments to feel fast, familiar, and available inside the services they already use. When the payment experience belongs to your brand, it becomes easier to guide users through a smooth journey. This approach often creates stronger engagement, more frequent interactions, and better visibility into customer behavior.

For many companies, a branded wallet is not only a digital payment tool. It becomes part of a broader engagement strategy.

Why Building E-Money Internally Is Challenging

Creating and maintaining an e-money service requires a large amount of coordination across technology, compliance, operations, and partner integrations. Many businesses face long development timelines, several connection points with payment and financial institutions, ongoing regulatory work, and continuous infrastructure maintenance. These challenges slow down progress and make scaling difficult.

A Simpler Approach With Indivara’s White-Label Platform

Indivara offers a ready-to-use platform that shortens the time needed to launch your e-money services and reduces the complexity that usually comes with building your own system.

Scalable architecture that supports growth in users, features, and transaction volume. The platform is prepared to accommodate higher activity as your services expand.

Flexible, pay-as-you-grow model so you can begin with essential components and activate additional capacity when the business requires it.

Smooth integration with your existing systems. The platform connects to your current environment without forcing major changes to what you already have.

A stable, long-term platform that grows with your business. The foundation is built for durability, which helps your services stay consistent as you continue to develop new offerings.

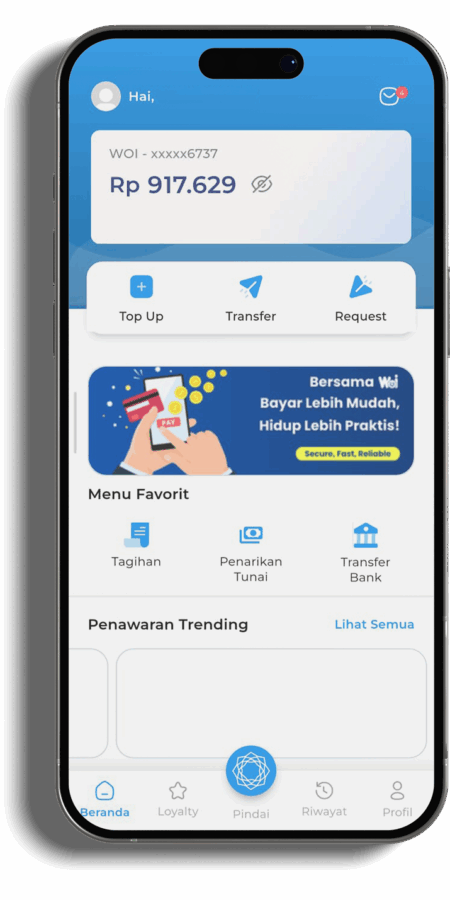

What Your Customers Can Do With Your E-Money Platform

Customers can enjoy various useful features inside your branded app:

QRIS Payments

A quick way to pay at merchants that support QRIS.

Bill Payments

A convenient option for settling utilities, mobile phone credit, data packages, and similar needs.

Bank Transfers

A practical ability to send funds directly to bank accounts.

P2P Transfers

A simple method for sending or requesting money fromfriends or family.

Split Bill (Coming Soon)

Simply upload a receipt. The app will detect the total and list the bill items automatically.

Sub-Wallet (Coming Soon)

A way for customers to organize funds into separate pockets for saving, budgeting, or allocating money to others.

Every feature encourages more meaningful interactions inside your ecosystem and adds convenience to everyday financial activities.

Integrated Loyalty Platform for Stronger Engagement

Our white-label e-Money platform is integrated with Indivara Loyalty so customers can earn and use rewards within the same experience.

Stronger Customer Retention Through Rewards

Every purchase or transaction inside your ecosystem can generate points. This creates a natural reason for customers to keep using your wallet for their everyday needs.

Access to a Shared Merchant Network

You do not need to build merchant partnerships from the ground up because the platform links you to an existing ecosystem of redemption options. Customers gain more ways to earn and redeem, while your brand remains the main identity in the experience.

Full Ownership of Your Loyalty Program

You control the points, rules, and membership levels. The branding follows your visual identity, so the loyalty journey feels like part of your own service rather than an external feature.

More Ways for Customers to Redeem

Customers can redeem points as vouchers, discounts, products, or services. They can also exchange points or convert them based on available redemption models.

Features That Drive Engagement

The loyalty module includes point transfers, receipt uploads for earning, membership tiering, gamified activities, flash promotions, and data insights. These tools allow you to shape meaningful experiences that encourage customers to return.

By combining e-money functions with an integrated loyalty engine, you create a single ecosystem where payments and rewards support each other. Customers receive a smoother journey, your team gains flexibility to build new use cases, and your brand stays at the center of the experience. This structure gives you a strong foundation to scale while remaining adaptable to new features and opportunities.

Start Building Your E-Money Experience

A branded e-money platform no longer requires years of development. You can launch faster and operate with more confidence by using a white-label foundation that already meets industry requirements.

If you would like to see what the platform could look like for your business, you can schedule a consultation with our team.