Southeast Asia’s Wealth Boom Meets Rising Complexity

Wealth management across Indonesia, the Philippines, and Singapore is undergoing rapid transformation driven by a growing affluent class, evolving regulations, and clients who expect faster, more transparent, and more personalized financial advice. Yet for financial institutions, keeping up with these shifts requires more than just digital adoption. It demands smarter, more connected advisory tools.

In Indonesia, the expanding mass-affluent segment and evolving investment rules are reshaping how advisors serve clients. According to Hubbis (2025), wealth managers are diversifying their offerings while navigating tighter compliance, creating pressure to deliver timely insights without compromising accuracy.

In the Philippines, a rising middle class and stronger digital adoption are fueling demand for accessible investment opportunities. However, many advisors still rely on manual client management, a barrier to responsiveness and scale. As Wealth & Society (2023) notes, improving data integration and automation will be key to unlocking this market’s potential.

Meanwhile, Singapore continues to stand as one of Asia’s most competitive wealth hubs. As Yahoo Finance (2025) reports, private banks and family offices are doubling down on personalization and real-time engagement to win client loyalty in an increasingly crowded field.

Globally, EY’s Global Wealth Research Report 2025 found that 45% of high-net-worth clients view wealth management as increasingly complex, while 29% are willing to switch advisors for more transparent and personalized service. Similarly, BCG’s Global Wealth Report 2025 highlights the need for wealth managers to improve advisor productivity, implying that fragmented workflows and inefficient processes limit time for meaningful client engagement.

Challenges That Hinder Effective Client Relationships

Despite the region’s progress in digital transformation, many RMs still face challenges that limit their impact and client relationships:

- Disjointed client data makes it difficult to get a full picture of each client’s financial journey, leading to slower and less personalized advice.

- Manual onboarding and transaction handling increase operational friction and risk, especially in compliance-heavy markets like Indonesia and Singapore.

- Limited proactive engagement means advisors often respond after opportunities have passed, missing crucial moments to connect and add value.

- Limited visibility into RM performance makes it harder for managers to track productivity and maintain consistent service quality.

How Avantrade’s RM Assist Elevates Every Client Interaction

Avantrade’s RM Assist was built to help Relationship Managers focus on what truly matters: advising clients, building trust, and growing relationships. By unifying data, streamlining engagement, and embedding insights directly into the RM’s workflow, RM Assist transforms daily tasks into meaningful opportunities for connection.

Here’s how RM Assist helps financial institutions overcome today’s biggest relationship management challenges:

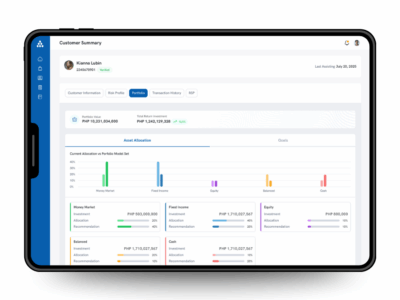

Unified Wealth View for Smarter Advisory

RM Assist integrates client portfolios, asset allocations, and account data into one 360° view. Advisors can instantly identify opportunities and deliver transparent, data-driven advice.

Frictionless Onboarding and Transactions

With integrated account opening, order management, and real-time tracking, RM Assist removes delays and minimizes operational risk. This streamlined approach is especially valuable for institutions operating under stringent compliance requirements in markets like Indonesia and Singapore.

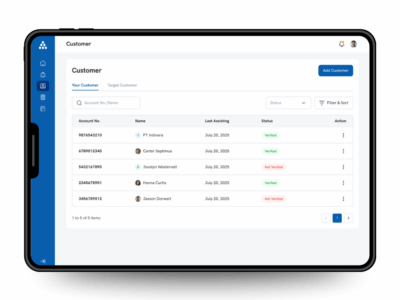

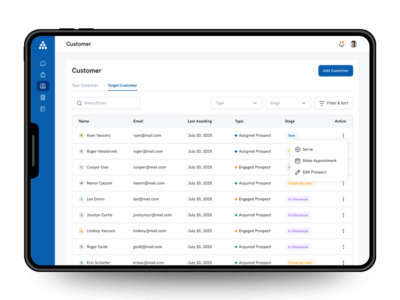

Proactive Client Engagement Tools

RM Assist helps advisors anticipate client needs by tracking life events, scheduling follow-ups, and surfacing relevant opportunities. In competitive markets like Singapore and the Philippines, this proactive engagement builds loyalty and retention.

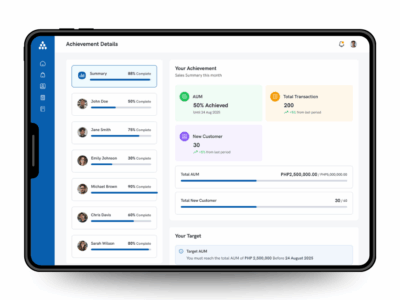

Performance Dashboards for Visibility and Motivation

Real-time KPIs and leaderboards allow institutions to track performance, set clear targets, and inspire consistent improvement.

With Avantrade’s RM Assist, Relationship Managers spend less time managing systems and more time building relationships, delivering faster advice, deeper insights, and measurable trust that sets their institutions apart.

The Future of Client Relationships Starts Here

As Southeast Asia’s wealth landscape continues to evolve, success will depend on how well financial institutions blend human insight with digital intelligence. Relationship Managers remain the cornerstone of client trust, but empowering them with the right tools is what turns that trust into growth.

With Avantrade, wealth managers can transform complexity into clarity, enhance every client touchpoint, and deliver personalized experiences that strengthen relationships and build long-term value.

Learn how Avantrade can help your institution redefine client engagement and scale smarter advisory experiences.