Building a reliable payment experience takes real effort.

For many e-money products, that effort is focused on making transactions fast, secure, and easy to complete.

At the same time, everyday spending often continues after the payment itself. People share meals, split travel costs, or manage group expenses once the transaction is already done. When these moments aren’t supported inside the app, users naturally rely on other tools to finish the process.

This isn’t about something being missing. It’s about how payment experiences can extend further into everyday financial behavior.

Where shared spending naturally continues

Shared expenses don’t follow a single pattern.

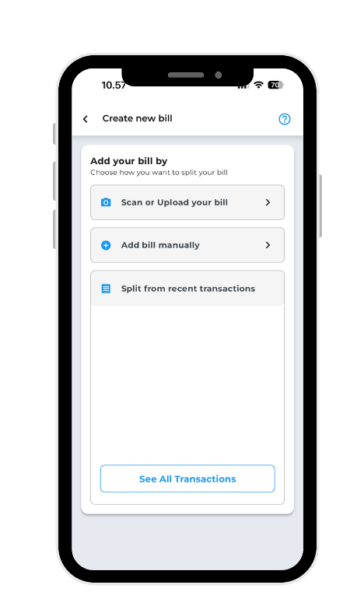

Sometimes there’s a receipt from an offline purchase.

Sometimes the payment has already happened digitally.

Other times, it’s a shared cost that gets recorded later.

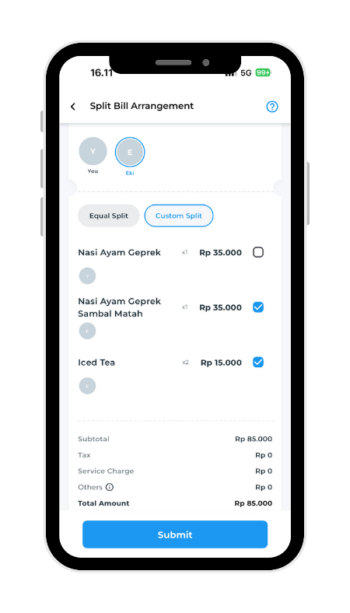

In reality, shared spending is fluid. It evolves over time, involves multiple people, and often requires adjustments before it is fully settled.

Supporting these moments inside the payment experience helps keep financial interactions connected, instead of ending abruptly at the transaction screen.

Designing for life after the transaction

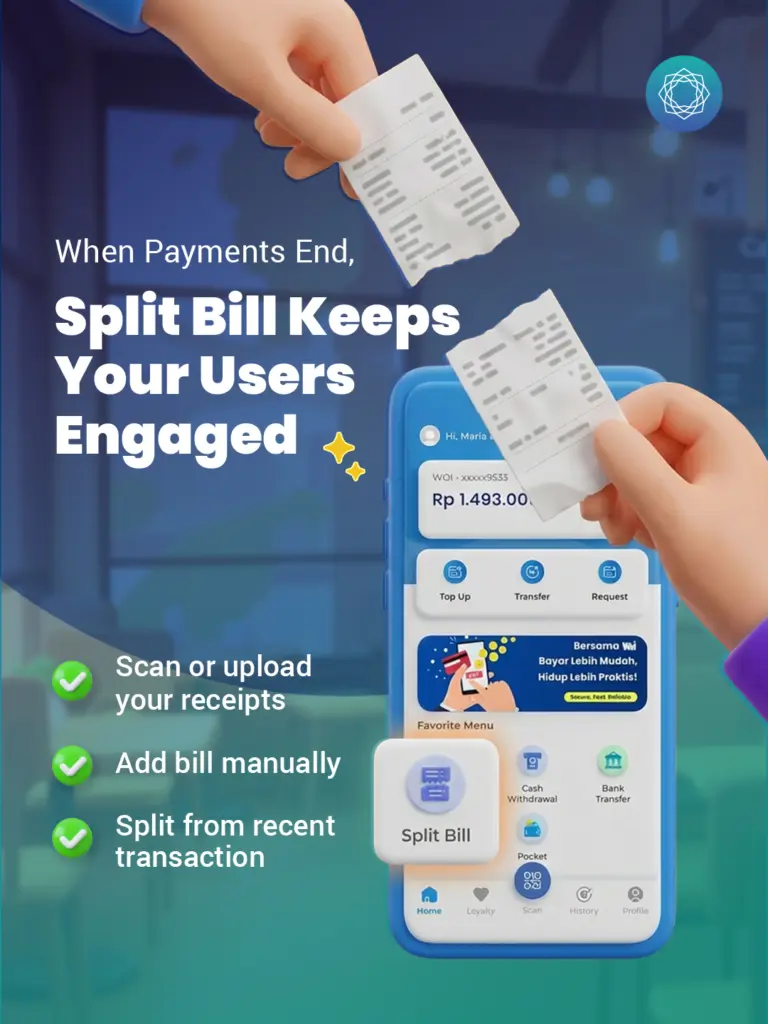

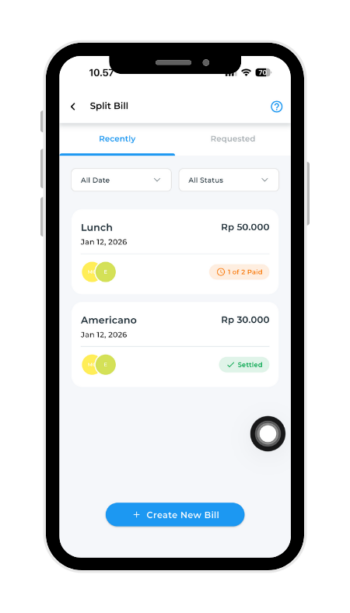

Split Bill is designed around this reality. It supports shared spending whether the payment has already happened or is still being worked out.

Users can start from a receipt, from a past transaction, or from a manually recorded expense, depending on how the situation unfolds.

More importantly, it allows shared expenses to evolve naturally, reflecting how groups actually review, adjust, and settle costs over time.

Instead of forcing everything into a single step, the experience stays flexible, accommodating the back-and-forth that typically follows group payments.

Why this supports ongoing engagement

When users can manage shared expenses in the same place they pay, interactions extend naturally beyond a single transaction.

Rather than reopening the app only when they need to pay again, users return to:

-

Review shared expenses

-

Settle balances

-

Manage group spending over time

These repeated touchpoints help the app remain relevant across more moments in daily life.

Built into WOI’s white-label platform

WOI is Indivara’s white-label e-money platform, built to help companies deliver payment experiences that feel complete and continuous.

Split Bill is part of that approach. It integrates alongside existing payment flows and transaction types, adding depth without introducing unnecessary complexity. For businesses, this means the ability to support shared spending without redesigning core payment journeys.

Interested in exploring this further?

If you’re planning to launch a white-label e-money app and want to see how features like Split Bill can support long-term engagement, our team is happy to discuss your use case.

Contact us to learn how WOI can be integrated into your app roadmap.