Built on 20+ Years of Trust

in Wealth Management

Since 2003, Avantrade has been the trusted choice of Asia’s leading financial institutions. With 20+ years of innovation and proven market leadership, it powers 70% of transfer agents and 10,000+ branches across the region.

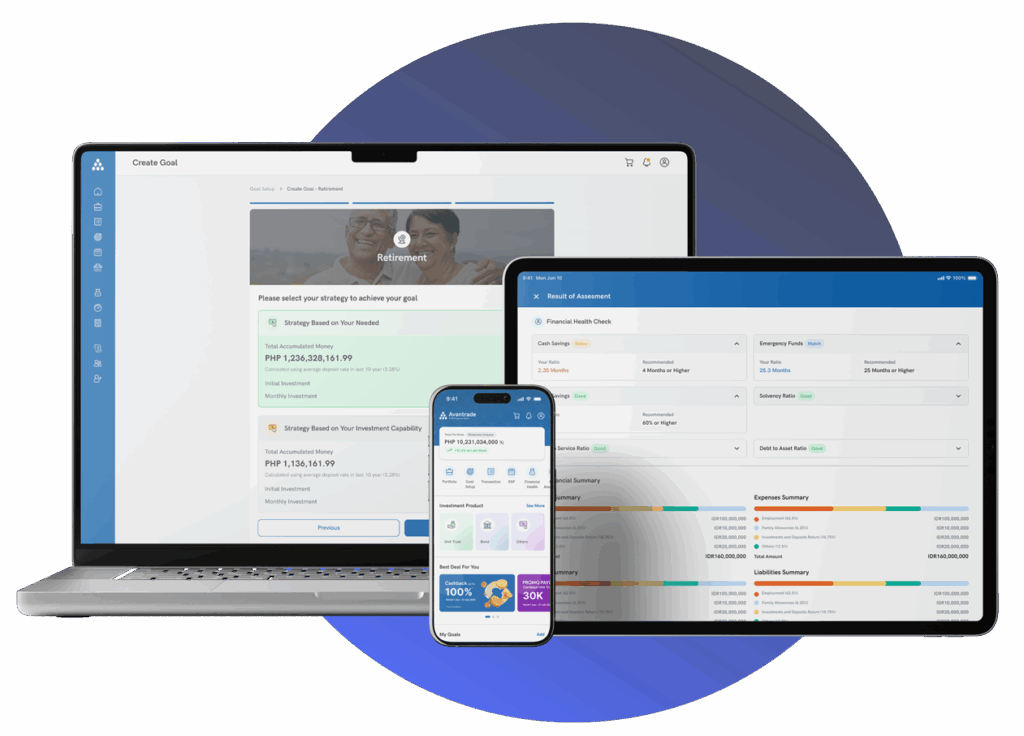

Designed as a modular, white-label platform, Avantrade unifies investment, advisory, compliance, and client experience into one integrated system, helping institutions deliver more value with confidence at scale.

Why Choose Avantrade

Unified Digital & Wealth

Bring banking and wealth management together in one ecosystem, delivering a seamless experience for clients across digital and assisted channels.

Future Ready Architecture

Cloud-native and modular by design, Avantrade reduces infrastructure costs, accelerates deployment, and scales as your business grows.

Growth Aligned Commercial Model

Avoid heavy upfront licensing. Avantrade’s flexible model lets you pay as your assets under management grow.

Adoption Build In

Avantrade’s open API architecture enables seamless integration with existing systems, making it easy for institutions to adopt, scale, and connect across their digital ecosystem.

Compliance by Design

Built with flexibility at its core, Avantrade allows institutions to configure rules and workflows aligned with both internal policies and evolving regulatory requirements across markets.

Trusted Partner

About 70% of Transfer Agent (Banking) in Indonesia backed by Avantrade Unit Trust Sales since 2003.

Integrated Platform for

End-to-End Wealth Management

Avantrade connects the entire wealth management ecosystem — from

front office engagement to back office operations — in one unified,

white-label platform.

Front Office Solutions

Deliver personalized, omnichannel experiences through assisted and

self-service platforms.

Back Office Solutions

Streamline fulfilment and processing for banks, non-bank institutions, and third-party selling agents across modules such as Pricing Maintenance, Dividend Processing, and Product Fulfillment.

Front Office Solutions

Best suited for institutions aiming to:

- Deliver personalized, advisor-assisted experiences with digital precision

- Strengthen client engagement through assisted and self-service journeys

- Enhance consistency in client servicing

Self-Service Digital

Wealth Management Platform

Give your customers the power to invest, grow, and manage their wealth — seamlessly inside your mobile and internet banking platforms. Whether as a standalone app or embedded within your existing mobile or web channels, Avantrade delivers a flexible experience that supports iOS, Android, and web browsers.

Key Capabilities Designed for Digital Investors:

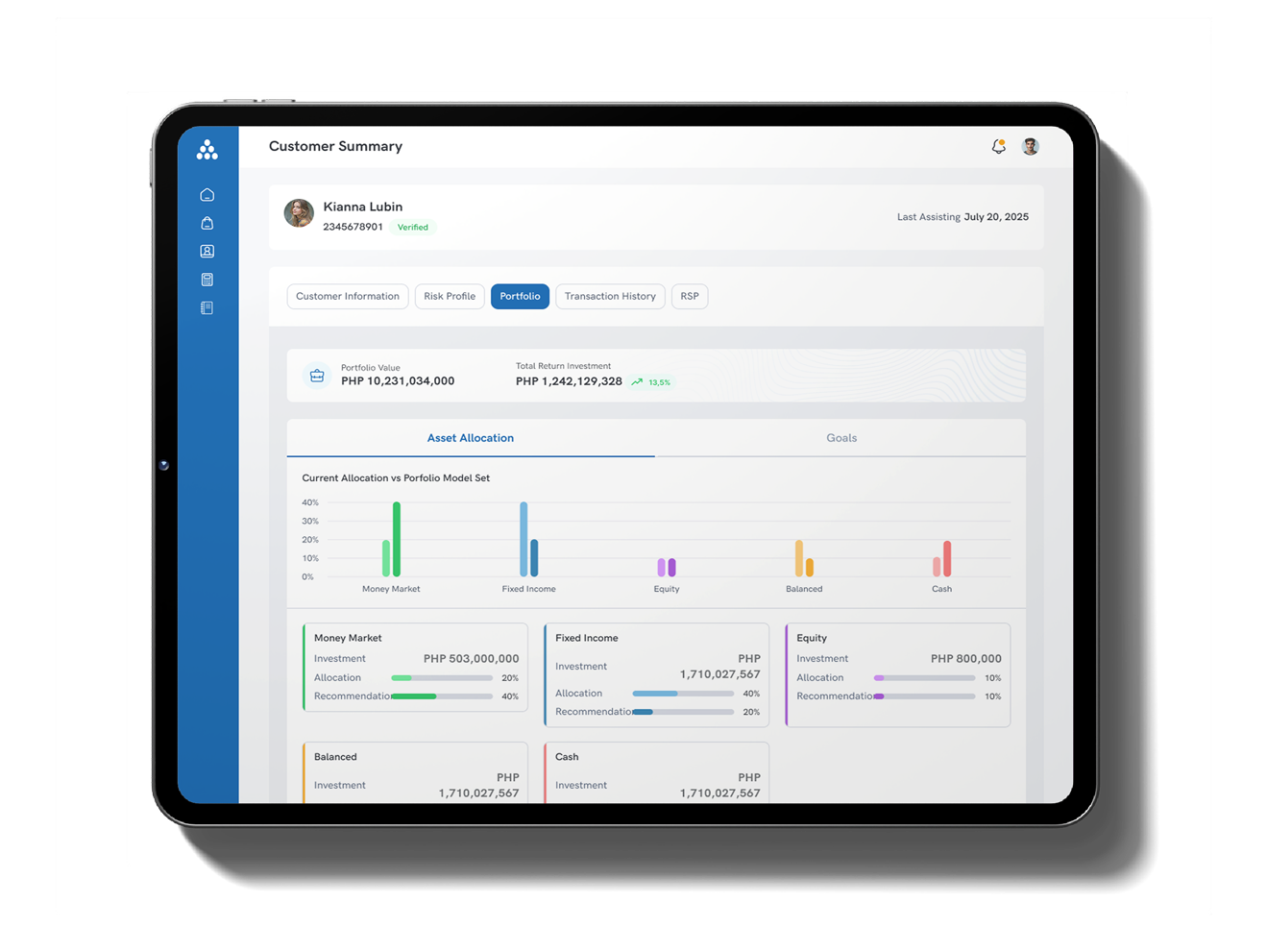

RM Assist

RM Assist empowers Relationship Managers with digital tools that enhance communication, streamline engagement, and elevate client service. By improving RM effectiveness and enriching every interaction, the platform helps financial institutions deliver more personalized advice and build stronger, lasting relationships.

Key Capabilities

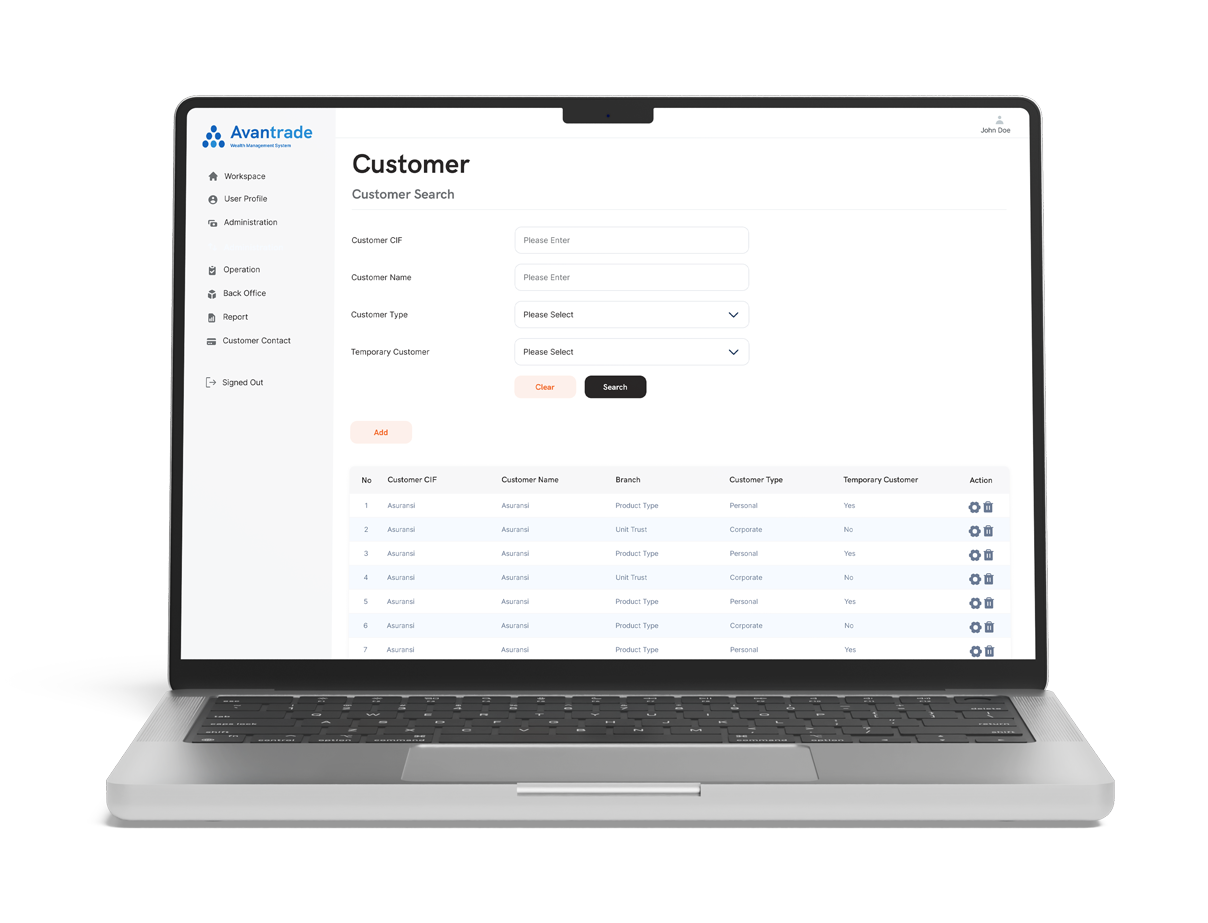

Back Office Solutions

Streamline the investment lifecycle with automation and operational precision.

Avantrade’s back office suite simplifies complex fulfillment and processing workflows for banks, non-bank financial institutions, and third-party selling agents, ensuring speed, accuracy, and compliance across every transaction.

Perfect for institutions seeking to:

- Enhance operational efficiency across investment and distribution channels

- Reduce manual workload and minimize reconciliation errors

- Maintain compliance and data integrity from front to back

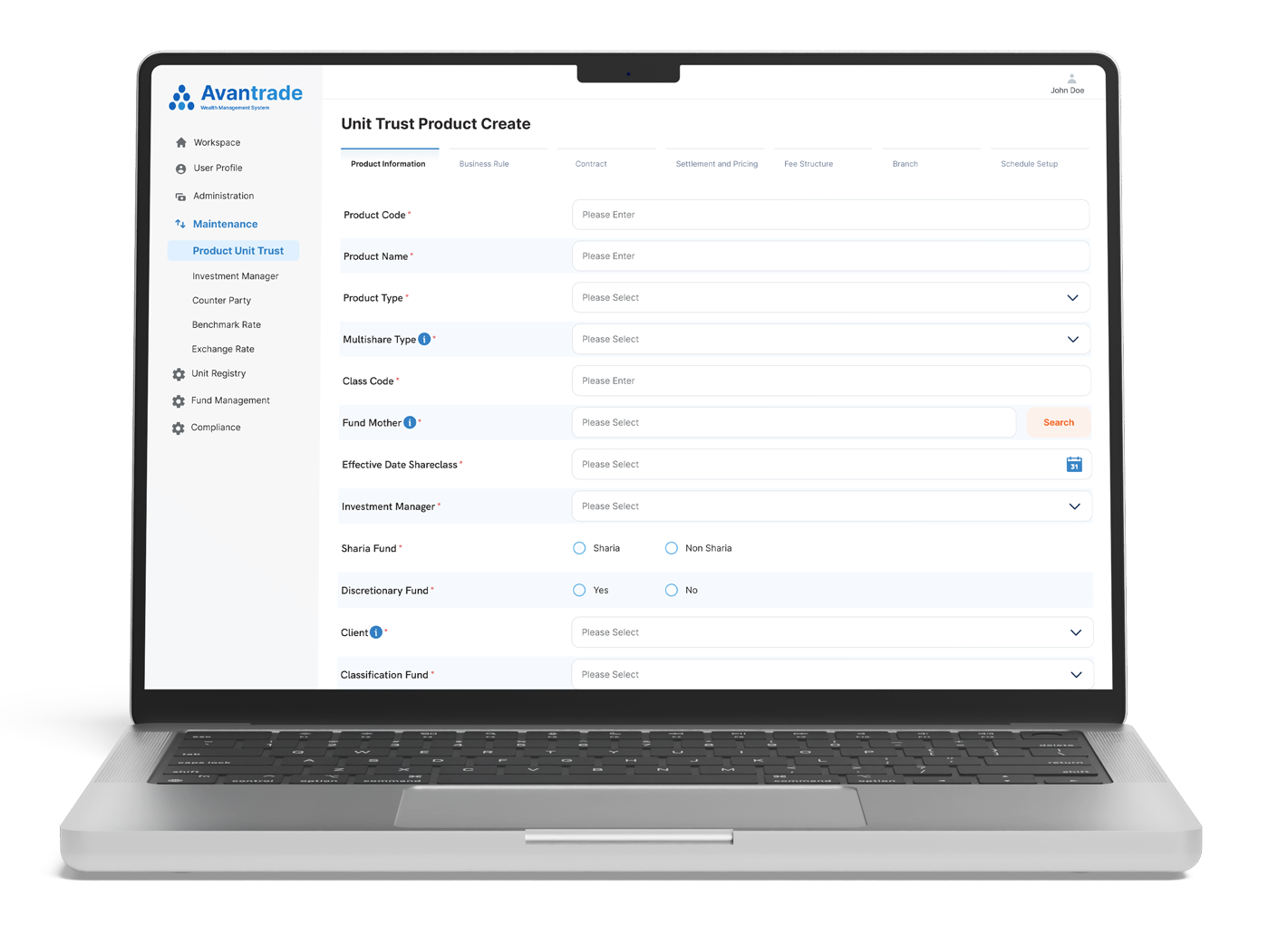

UNIT TRUST

Comprehensive tools for managing and distributing mutual funds, with real-time portfolio monitoring and compliance checks.

FIXED INCOME

Streamlined subscription, allocation, and redemption processes for bonds and other fixed-income products.

PRODUCT CATALOG

Simplify product setup for offerings like Time Deposits, Insurance, and ETFs, with easy integration to third-party systems.

LOMBARD LOAN

Flexible lending solutions backed by client assets, expanding product offerings and driving higher wallet share.

UNIT

REGISTRY

Accurate and transparent management of all investor holdings, with automated KYC validation and direct S-Invest integration ensuring seamless, compliant transactions.

FUND

MANAGEMENT

End-to-end portfolio management for Fund Managers, automating NAV calculations, transaction recording, and performance tracking, all in real time.

COMPLIANCE RULES

ENGINE

Automated checks on every transaction and portfolio position to prevent breaches, ensuring full adherence to OJK regulations and internal policies.

FUND FACT SHEET

BUILDER

Instant, regulator-ready fund reports powered by automated portfolio, NAV, and benchmark data — keeping every fact sheet accurate and consistent.

Unit Trust

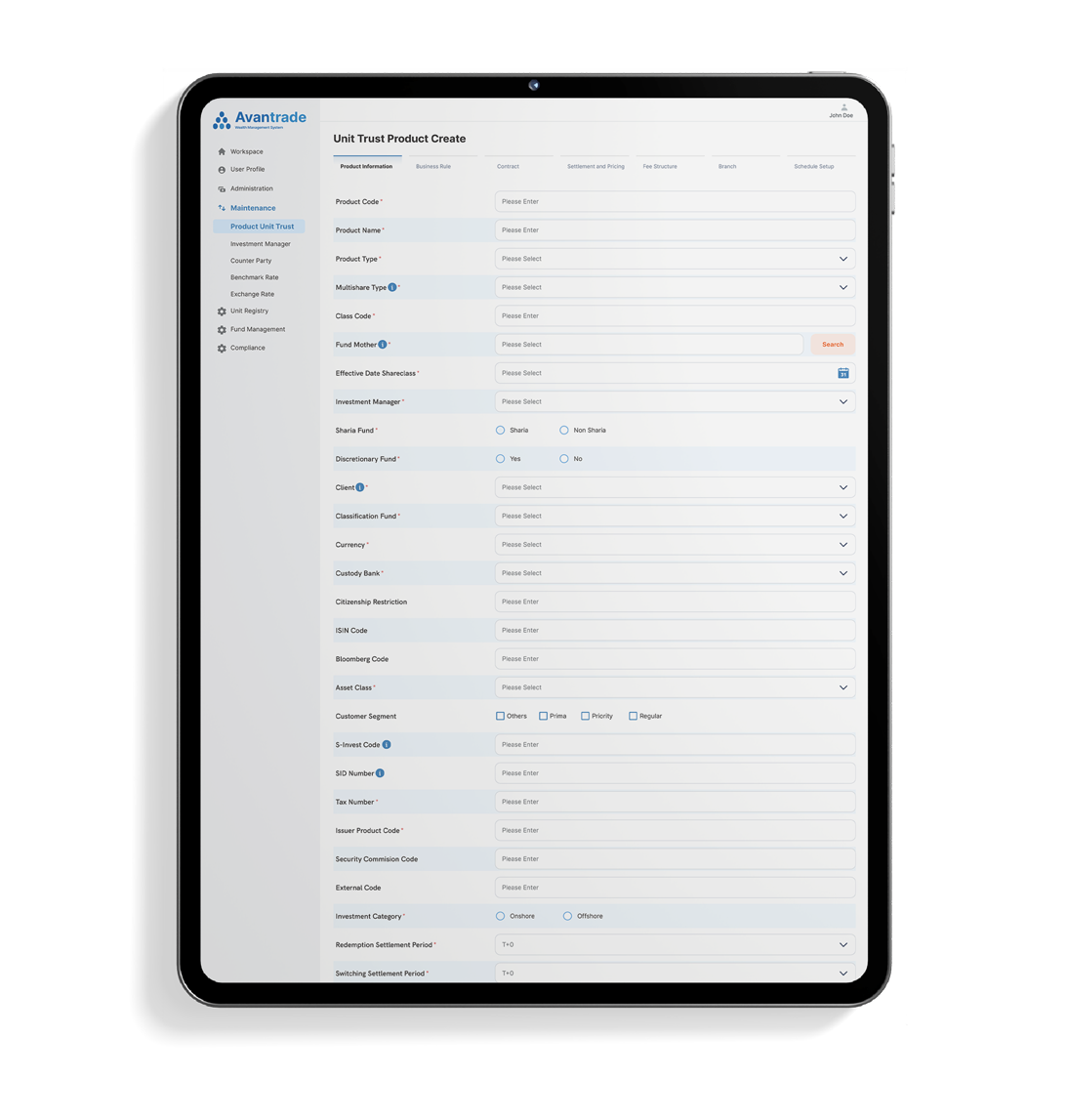

Avantrade’s Unit Trust module covers every aspect of mutual fund operations, from product management and transaction processing to compliance and reporting. Built to handle complex variations with ease, the platform helps financial institutions streamline fund distribution, ensure regulatory alignment, and deliver a smooth investor experience.

Key Capabilities:

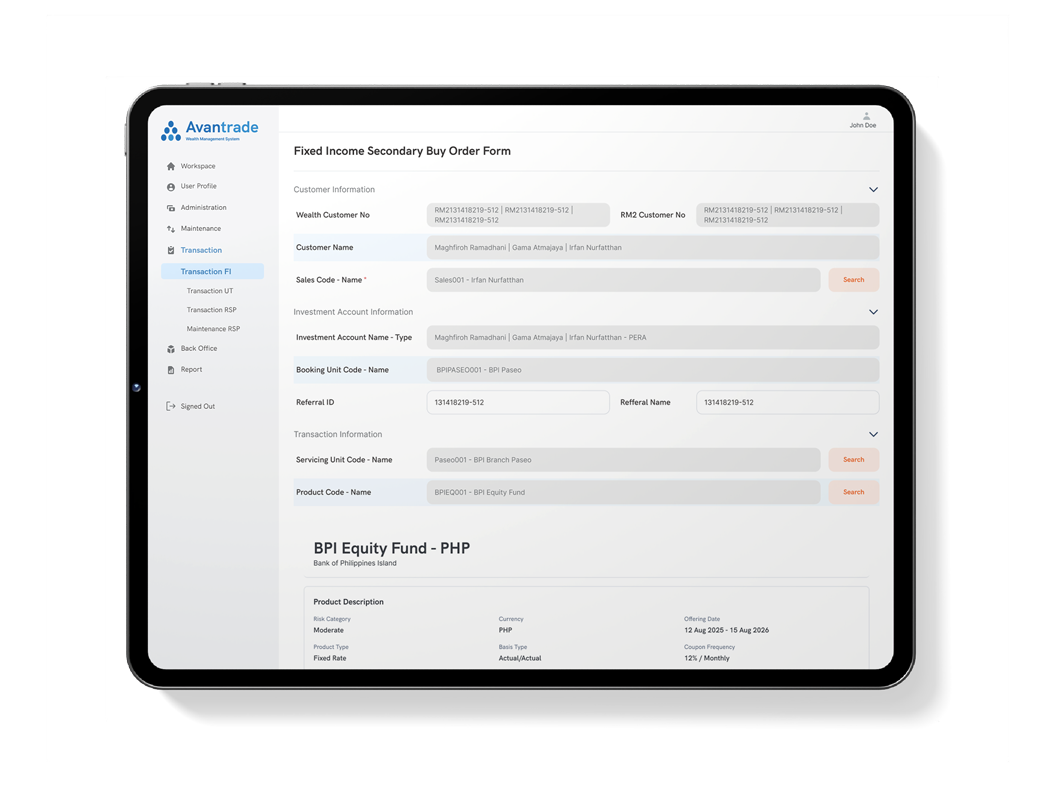

FIXED INCOME

Avantrade’s Fixed Income module streamlines every aspect of bond distribution and management, from product setup and transaction handling to compliance and reporting. Built to support both primary and secondary markets, it enables financial institutions to expand fixed income offerings, improve transparency, and deliver a seamless investor experience.

Key Capabilities:

PRODUCT CATALOG

Product Catalog provides a centralized setup for all investment and wealth products, including Time Deposits, Insurance, ETFs, Bonds, and more. It streamlines product creation and maintenance, ensuring consistency across channels and systems. With flexible configuration options and ready integration to third-party platforms, financial institutions can easily expand offerings, update product details, and accelerate time-to-market for new investment products.

Key Capabilities:

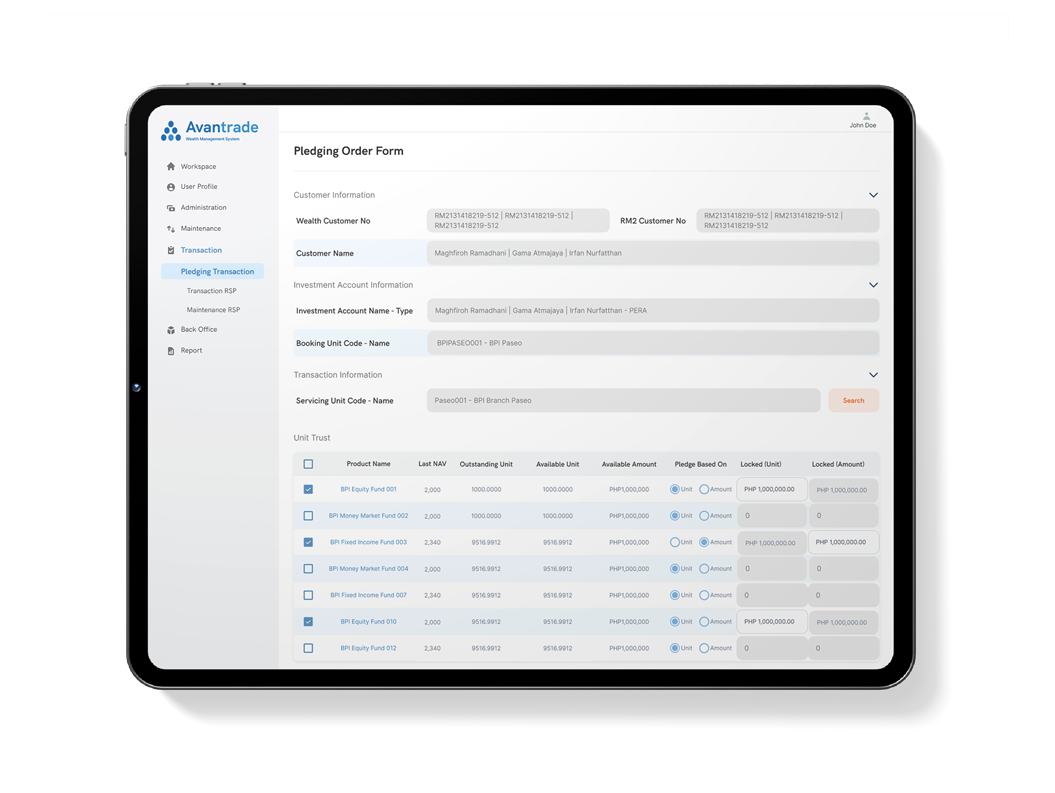

LOMBARD LOAN

Avantrade’s Lombard Loan module empowers financial institutions to offer flexible credit facilities backed by secure collaterals. With automated loan-to-value (LTV) options, daily monitoring, and seamless integration with core banking systems, it ensures both customer convenience and institutional risk control.

Key Capabilities:

UNIT REGISTRY

Avantrade’s Unit Registry module manages all investor holdings with accuracy and transparency. Subscription, redemption, switching and others transaction processes, with built-in KYC validation and direct integration to S-Invest. This module ensures every transaction is properly recorded, compliant with regulations, and easy for all parties to reconcile.

Key Capabilities:

FUND MANAGEMENT

Avantrade’s Fund Management module helps Fund Managers efficiently manage daily portfolio activities. From recording investment transactions and calculating NAV to monitoring fund performance, everything is automated and real-time. It ensures every investment decision aligns with the fund mandate and OJK regulations.

Key Capabilities:

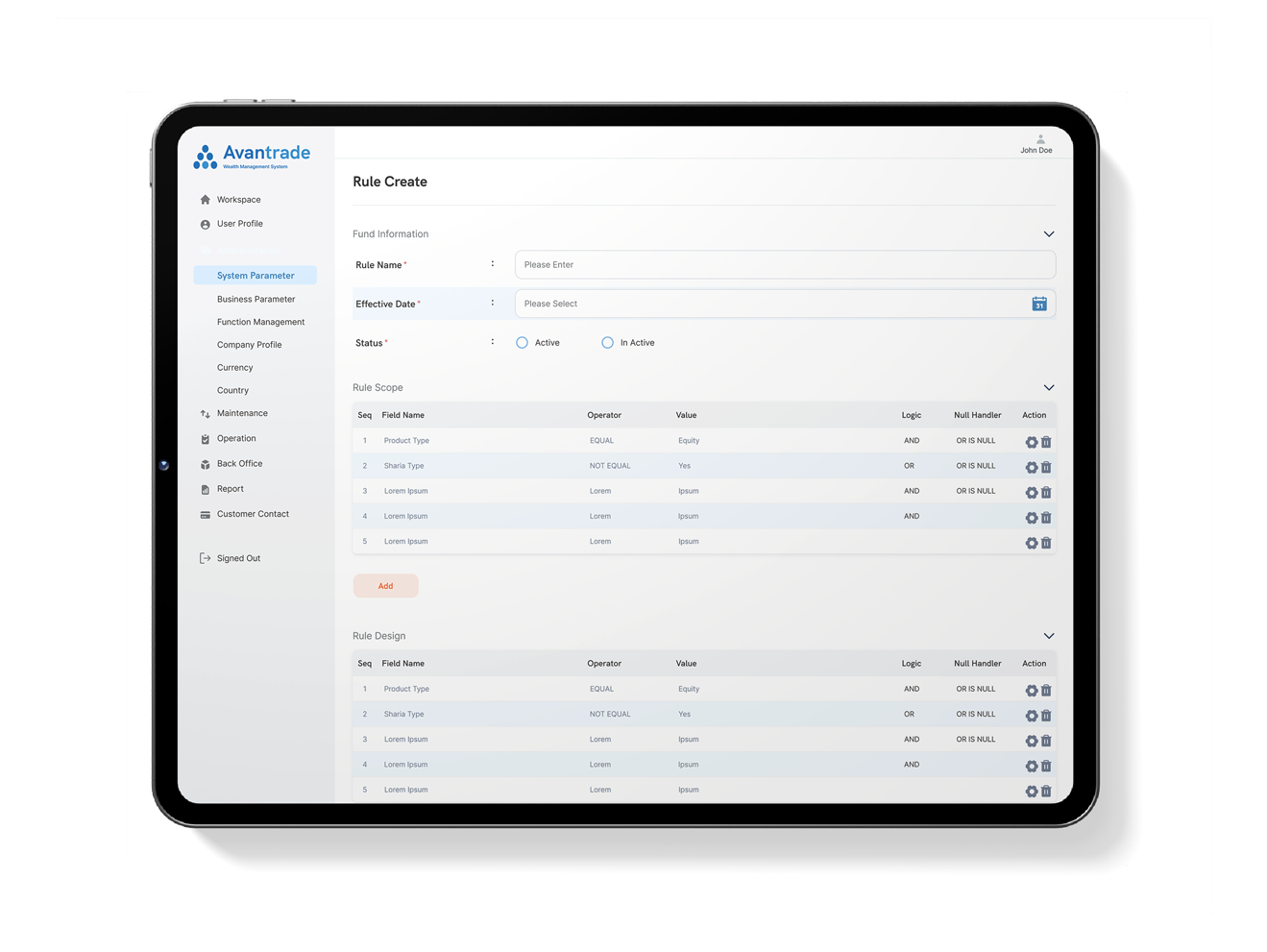

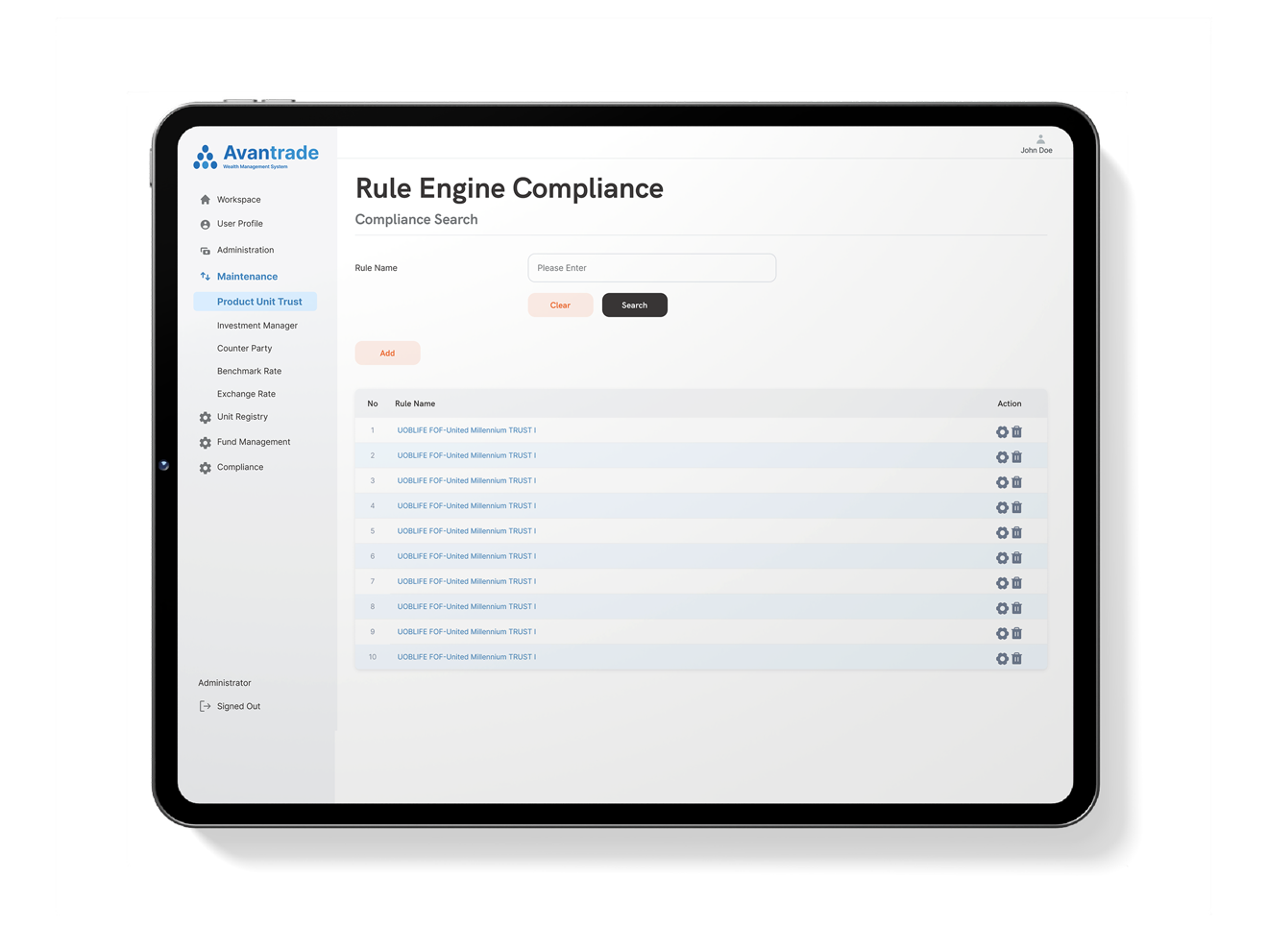

COMPLIANCE RULES ENGINE

Avantrade’s Compliance Rules Engine automatically checks every transaction and portfolio position to ensure compliance with OJK regulations and internal policies. It alerts users before any potential breach occurs, helping Fund Managers and distributors maintain transparency, control risks, and stay fully compliant.

Key Capabilities:

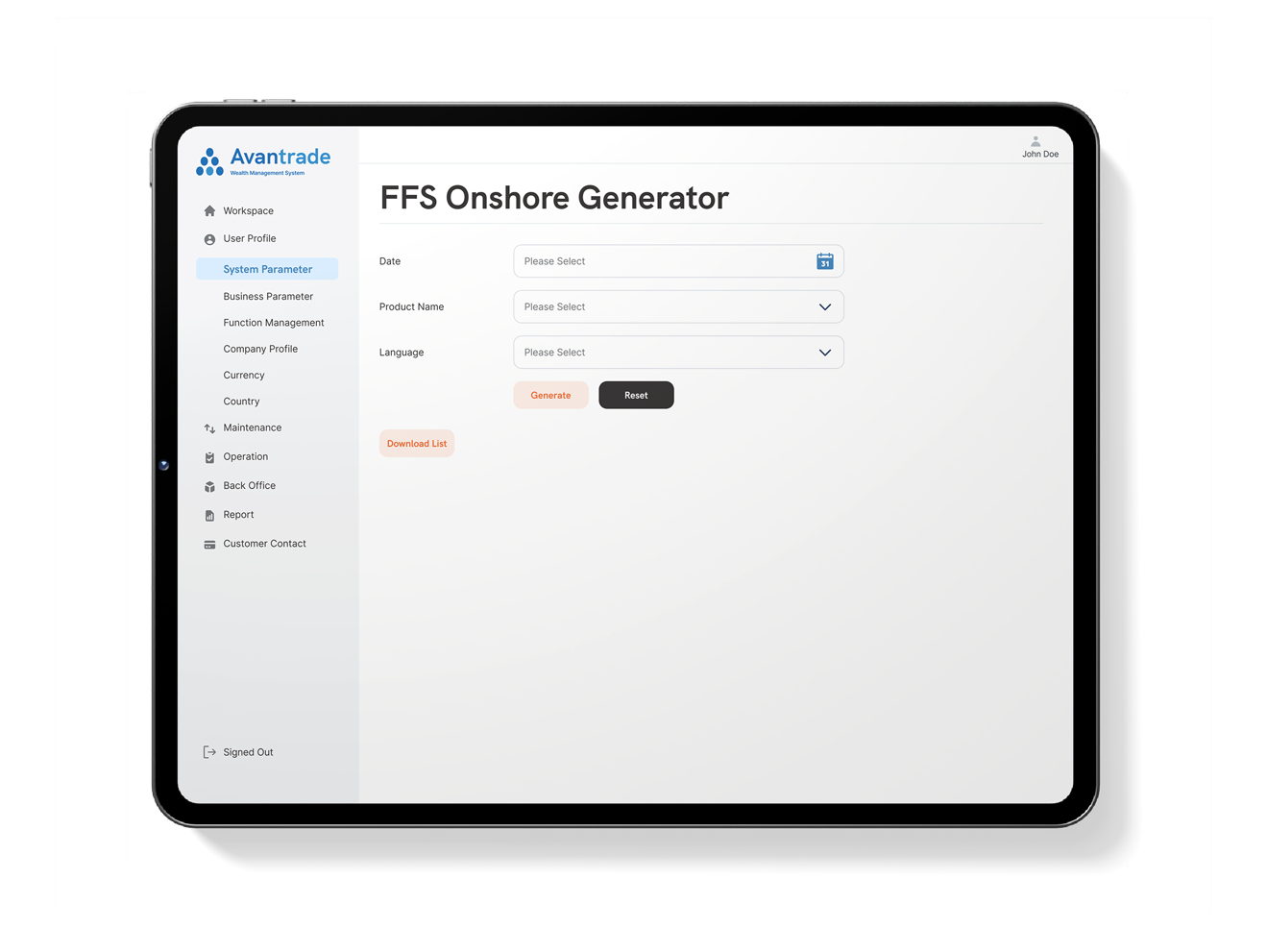

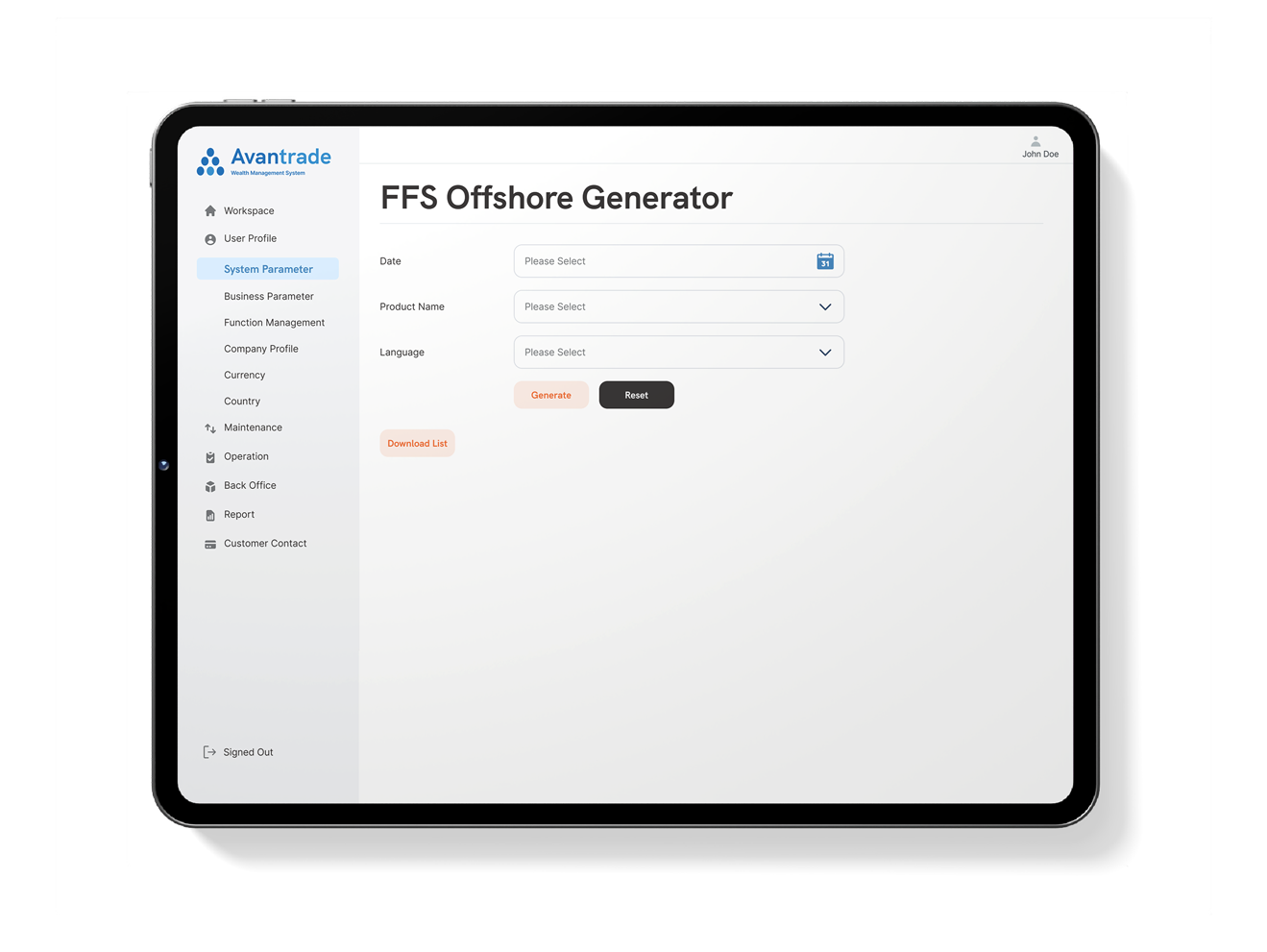

FUND FACT SHEET BUILDER

Avantrade’s Fund Fact Sheet Builder simplifies the preparation of fund performance reports quickly and consistently. Portfolio, NAV, and benchmark data are automatically collected to generate accurate, regulator-ready reports for investors and partners. This module ensures every fund fact sheet remains up to date and aligned with industry standards.

Key Capabilities: